[Work in progress]

Bet on yourself—without losing a dime

Moneyvation helps people stay motivated and accountable without the fear of failure.

“I bet you $$$ that I will go to the gym !”

Problem

Small bets are easy to ignore, but

big bets feel too risky to make.

Money can be a strong motivator. Let’s imagine a friend struggling to get to the gym. To stay motivated, they make a fun, low-stakes bet with you. They start strong, but life gets busy, motivation slips, and they lose the bet. So what if they made a bigger wager, one that actually felt meaningful?

Stakes need to feel real—without

feeling like a real loss.

Solution

Insight

It’s a Catch-22: you need high stakes for the bet to feel real, but when motivation is low to begin with, betting feels risky. To soften the risk, people either lower the stakes, which lowers the motivation, or they shirk away from betting at all, staying stuck.

A bet that pushes, but doesn’t punish. Money is withheld—never lost—and earned back in small wins that build momentum.

Moneyvation leverages the motivating power of a big bet while removing the fear of a big loss. The idea is that instead of losing the wager altogether, it’s just simply held by an accountability partner. Complete a task, earn a little back. Miss one? Add more to your pot. The stakes feel real, but the loss doesn’t, helping build momentum one step at a time.

How it works

Create Bet

Start by defining a goal and setting the terms (wager, payout amount, schedule, etc.)

Place It

Place the bet with an accountability who holds onto the pot

Claim a Payout or Add to the Pot

Completed a task? Request a payout. Missed one? Pay more into the pot. A penalty is 2x the payout amount, so two tasks must be completed to make it up!

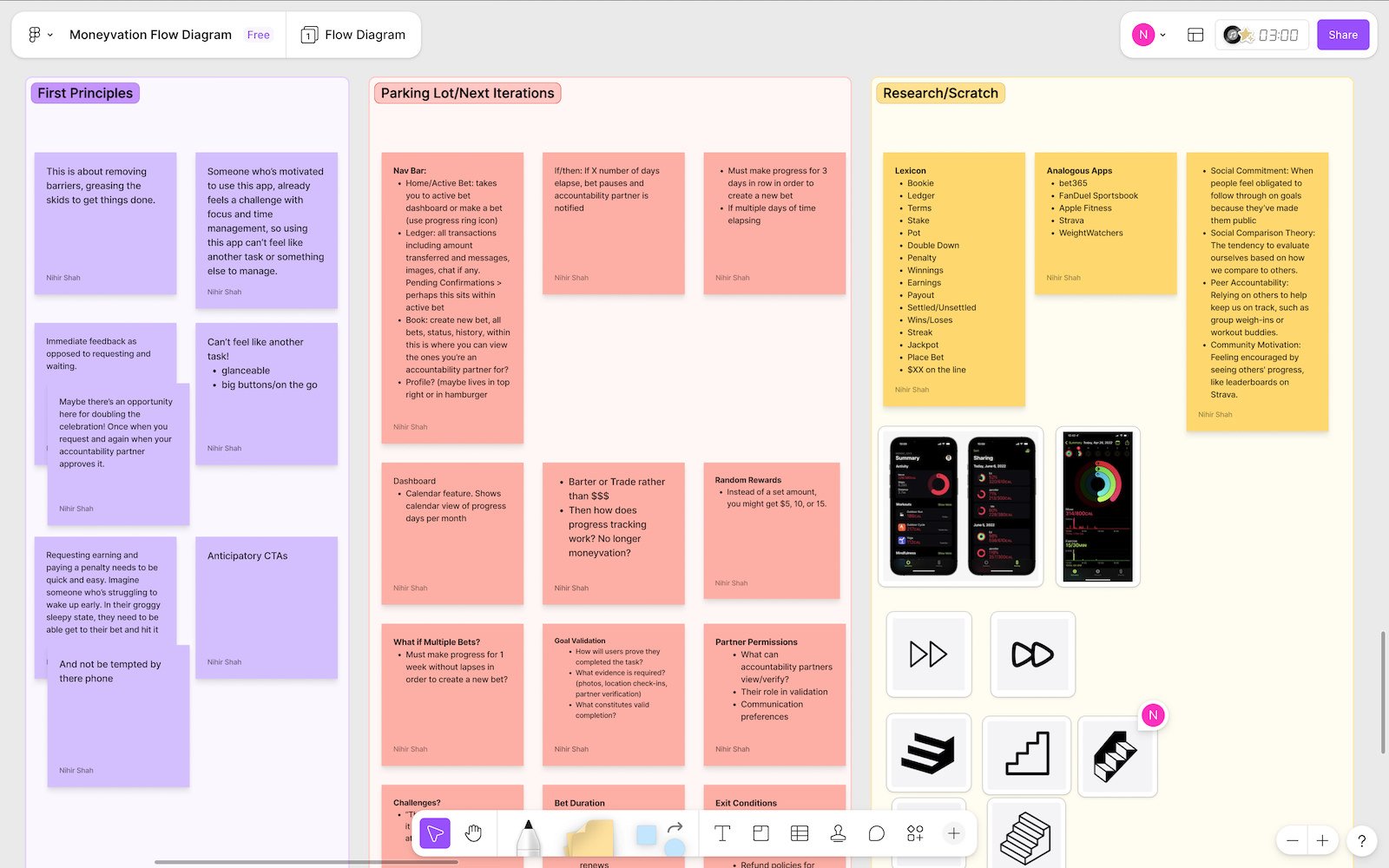

Developing the Design POV

The experience can’t feel like another task or something else to manage.

I started by defining a Design POV. I imagined a student using Moneyvation to build a habit of waking up earlier. In their groggy, half-awake state, they need a simple screen with less visual noise and limited interactions. They need to be in and out of the app quickly so they don’t fall into their phone.

Or a busy parent

Or consider

Core Needs

Getting started

Finding consistency

Managing Distractions

Core Behavioral Principles for Motivation

-

1.

Financial incentives create tangible stakes that trigger loss aversion and reward pathways by connecting action with outcome.

-

2.

Social accountability leverages our desire for positive perception and fear of letting others down.

-

3.

Breaking down goals into smaller tasks reduces overwhelm and provides frequent wins, fueling motivation while building momentum and confidence.

-

4.

Progress visualizations satisfy our need to see concrete movement toward goals, while tapping on our nature to close the loop on incomplete tasks.

-

5.

Consistency over intensity prevents burnout and builds psychological momentum, while celebrating small wins activates reward pathways to reinforce continued effort.

Defining the Design Direction

These needs and principles call for a pared-back user experience, with anticipatory and prompt-driven interactions.

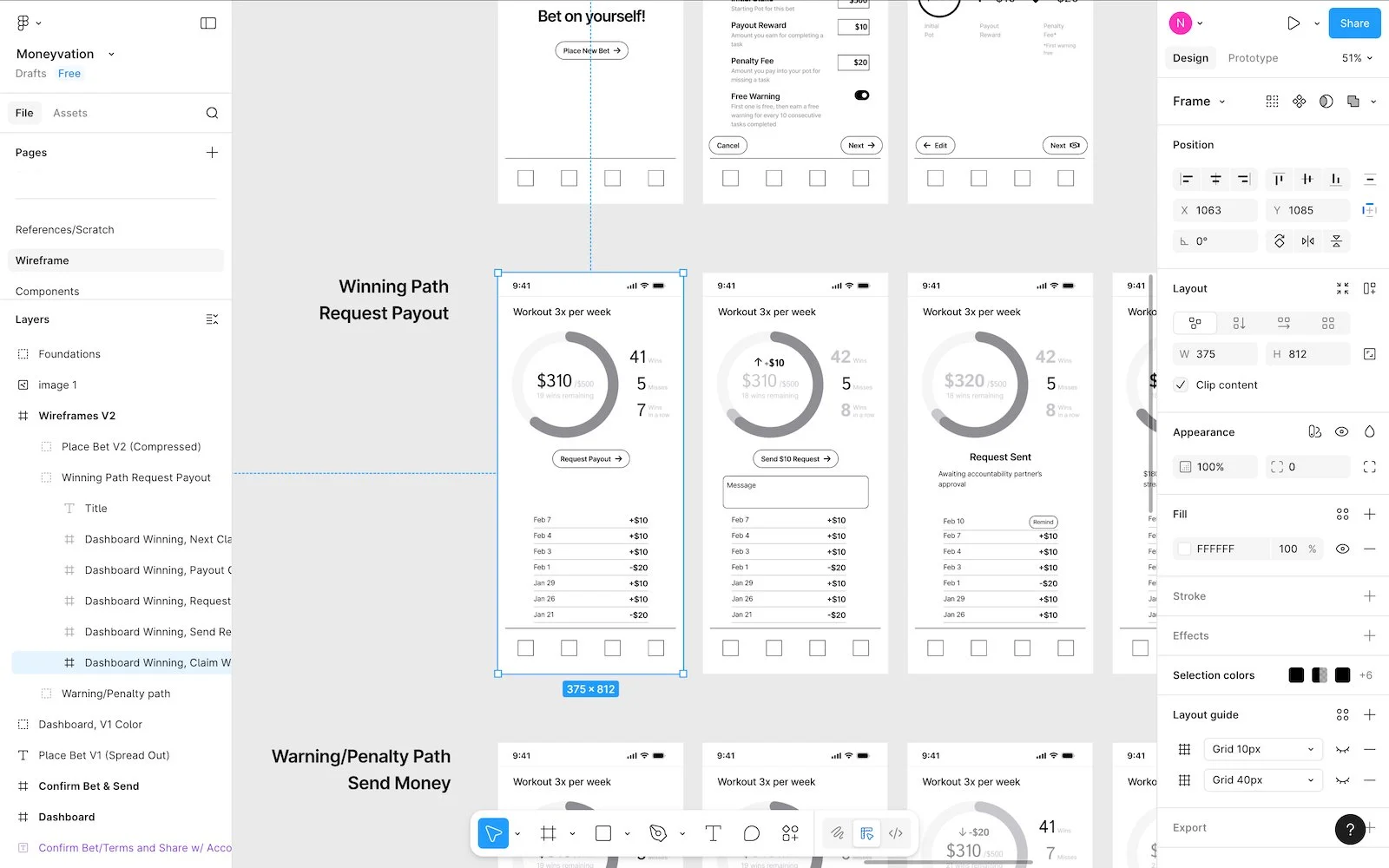

The UX/UI is distilled to quick check-ins, reduced interactions, simple and productive confirmations, at-a-glance metrics, and larger tap targets

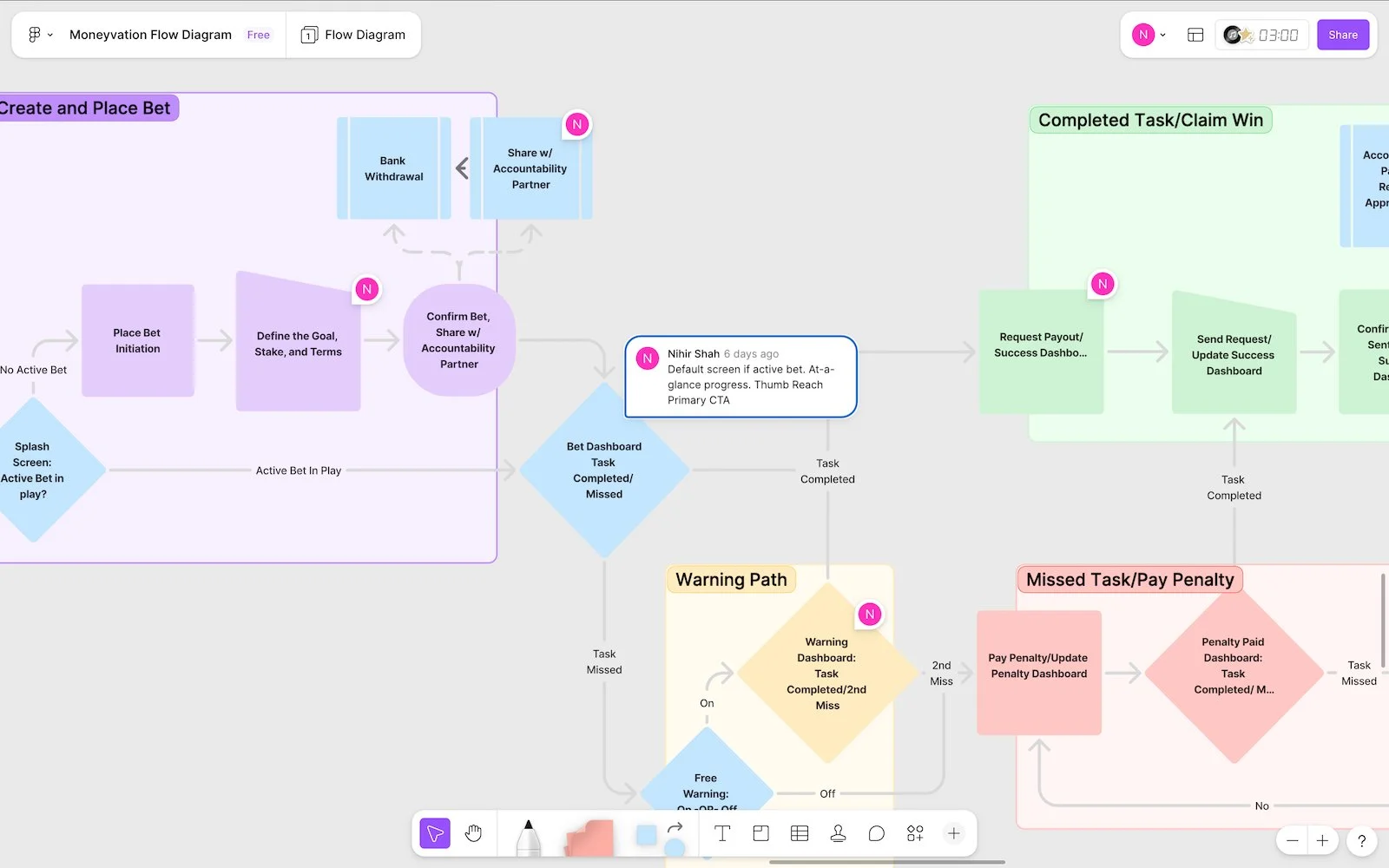

I moved back and forth between sketching out quick wireframes and users flows, this surfaced (bullet list?) first principles, ideas that needed to be incorporated into V1, assumptions that needed to be tested, ideas and questions that needed to go into the parking lot…, identify elements and key aspects of the user experience.

wireframe and flow diagram

V1 > What worked? What didn’t?

videos? smaller, + one big image with call outs (and critique. how to show?)

V2 > Current Iteration

If I had more/less time

-

Is an accountability partner necessary? Would self-accountability suffice or a non-human entity?

What level of interaction do users prefer?

Does the honor system provide sufficient accountability, or do users need more ways to prove task completion?

Do users feel loss aversion or will they simply allow the penalties to stack? How much?

Is the progress ring understandable for long-term goals? At-a-glance? Are variations/updates noticed?

How effective is the ledger in showing progress? Momentum?

-

A/B test for layout, navigation, progress display preferences, and accountability mechanisms

User interviews and card sorting to understand motivation patterns. pain points, and preferences

Moderated usability testing with think-aloud protocol, including comprehension probing and first-click/first-glance tests

User surveys to explore relationship and interaction with accountability partner

Test AI-assisted goal creation vs. manual input

-

Variable reward system using random payouts to gamify and reinforce actions toward goals

Community motivation features, like optional leaderboards or shared goals.

Challenges, Sprints, Stretch Goals, and Bonus Rewards. e.g. “If I workout 5 days in a row, I get a $50 bonus”.

It can be hard to feel progress, especially when just getting started on a long-term goal. HMW give users a sense of daily progress? Complete day rings like in Apple Fitness?

Research, Validation, and Testing

If I were to take more time with this project, I would shift into research, validation, and testing before advancing functionality any further. This would start with identifying assumptions embedded in the design and, through user testing and surveys, exploring feature concepts that emerged in this iteration.

If I had less time, I would have narrowed the scope to two key flows—Placing a Bet and a Successful Task Completion (a “Win”)—focusing on testing core assumptions around motivation and usability. After all, the other flows—Warning and Penalty—would mirror the same structure and patterns to maintain consistency and intuitiveness.

In case you’re wondering

Revenue model/Monetization Strategy

For consideration, Moneyvation could follow the PayPal/Venmo Model. As a custodian, Moneyvation could pool holdings to earn interest and invest in low-risk assets, while maintaining enough liquidity to cover withdrawals.